How the maritime industry is preparing for alternative fuel adoption

The energy transition is advancing, but not at the same pace everywhere. In 2015, just 0.7% of new cars sold were electric; by 2024, that figure had surged to 22%. Over the same period, solar’s share of global electricity generation increased sixfold.

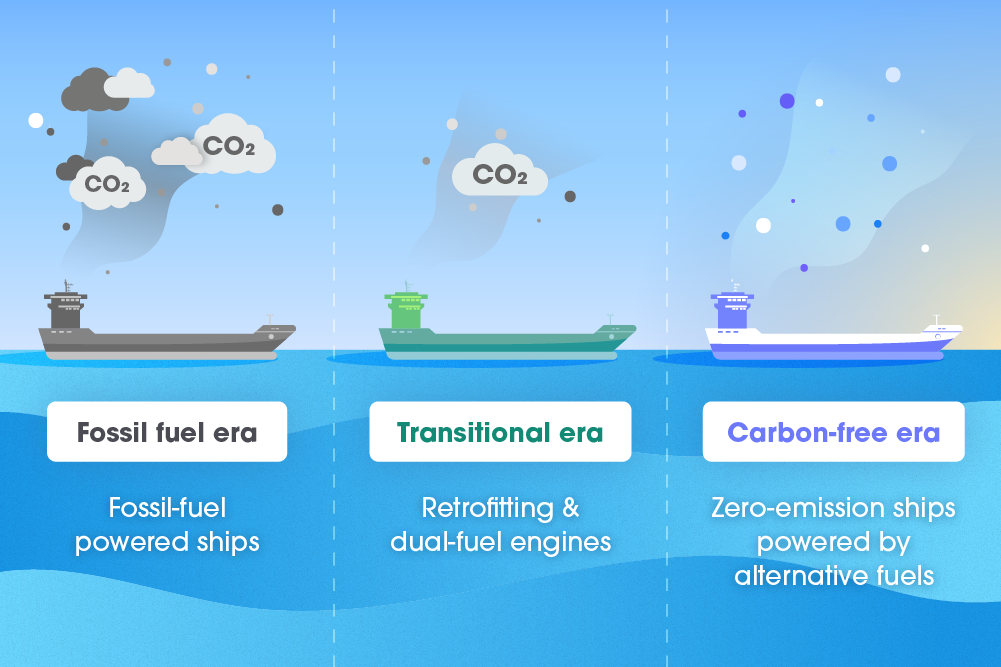

Shipping, by contrast, is harder to decarbonize. Vessels are capital-intensive, governed by strict safety regulations, and built to operate for decades. For shipowners, switching fuels isn’t just a technical upgrade — it’s a long-term commitment shaped by policy, infrastructure, and commercial risk.

Yet momentum is building. Alternative fuels like hydrogen and ammonia, already in use across energy and transport, are beginning to gain traction at sea. The following insights, drawn from DNV’s white paper Safe Introduction of Alternative Fuels, provide valuable information from pilot projects, classification experience, and regulatory developments, illustrating how these fuels are entering the market, and what it will take to enable broader adoption.

1. Why are alternative fuels like hydrogen and ammonia relevant to shipping now?

The International Maritime Organization has set ambitious decarbonization targets: a 20% reduction in greenhouse gas emissions by 2030, 70% by 2040, and net-zero by 2050 — all relative to 2008 levels. These goals cannot be met through efficiency improvements alone. Lower-emission fuels will be essential.

Hydrogen and ammonia are emerging as leading options because both offer carbon-free tank-to-wake operation and minimal air pollutant emissions. Their relevance is growing amid tightening emissions standards, increased investor scrutiny, and the need to future-proof fleets against rising compliance costs.

2. What progress is being made in adopting hydrogen and ammonia as marine fuels?

Hydrogen and ammonia are being introduced into shipping through dual-fuel vessel designs, which offer flexibility as supply chains and bunkering infrastructure develop. Hydrogen is being piloted in smaller vessels such as ferries and tugs, often paired with fuel cells. Ammonia is under evaluation in deep-sea shipping, including bulk and gas carriers.

Adoption remains limited, but progress is accelerating, driven by regulatory pressure, advancing technology, and first commercial orders. Dozens of ammonia-fueled ships are under construction or classified as “ammonia-ready.” Engine manufacturers are advancing hydrogen- and ammonia-compatible technologies, with commercial availability expected in the coming years. Interim class rules and regulatory frameworks are also improving approval pathways.

While no oceangoing vessels currently operate on hydrogen or ammonia alone, the technical and regulatory groundwork is steadily taking shape.

Hanwha received approval in principle from DNV for its marine hydrogen fuel cell system design in March 2025

3. What safety challenges do hydrogen and ammonia present at sea?

Hydrogen and ammonia introduce distinct safety risks that require new approaches in containment, vessel design, and crew preparedness.

Hydrogen is highly flammable, with a high leak risk and low ignition energy. It must be stored at cryogenic temperatures or high pressure, raising challenges around structural integrity, boil-off gas management, and fire prevention.

Ammonia is less flammable, but highly toxic. Even small leaks can be hazardous, requiring robust ventilation, controlled bunkering operations, and clearly designed escape routes. It is also corrosive and can degrade certain materials over time.

Both fuels demand marine-specific containment systems, rigorous design standards, and specialized training — particularly at sea, where space is limited and response windows are short.

4. What does successful adoption of hydrogen and ammonia require?

Scaling hydrogen and ammonia adoption at sea will require regulatory clarity, mature technology, ship design integration, and skilled crews — all underpinned by early collaboration across the industry.

Regulation is a critical factor: hydrogen- and ammonia-fueled vessels are not yet covered by the IMO’s IGF Code, which applies only to natural gas. Until at least 2028, they must be approved through a risk-based Alternative Design Approval (ADA) process, requiring proof of safety equivalence to conventional ships. Class societies such as DNV have issued their own rules, which, if accepted by regulators, can help streamline approval.

Meeting these future regulations will also demand changes in vessel design. Ships must accommodate the fuels’ lower energy density, often requiring larger tanks and more complex integration. Safety systems — including detection, ventilation, and emergency venting — must be designed specifically for maritime use.

Crew readiness is equally critical. Seafarers will need new skills to safely operate and maintain these systems, and to respond to emergencies. Until IMO standards are finalized, custom training programs, developed in coordination with Flag States and class societies, will be essential.

While interim guidance is supporting early projects, long-term clarity on regulations will be vital for widespread adoption.

A model of an ammonia carrier developed by Hanwha Ocean

5. What is Hanwha doing to support future-ready ship design?

Hanwha is advancing integrated, future-ready maritime solutions across propulsion, fuel systems, and vessel architecture — all with the goal of enabling zero-emission ship operations.

Hanwha Ocean and Hanwha Power Systems are co-developing an ammonia gas turbine with Baker Hughes that enables 100% ammonia combustion, eliminating the need for pilot fuel. The system has received Approval in Principle from the American Bureau of Shipping for LNG carrier applications.

Hanwha Aerospace is also developing a 200kW hydrogen fuel cell system for maritime use, which has received certification from DNV. To further enhance onboard safety, the company has introduced the world’s first immersion cooling energy storage system, certified by both DNV and the Korean Register of Shipping. Together, these technologies serve as critical building blocks for enabling fully electric, ocean-going vessels.

By combining energy generation, fuel handling, and shipbuilding within one group, Hanwha is uniquely positioned to accelerate the transition to safe, resilient, carbon-free marine technologies.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee