Envisioning the future with Hanwha General Insurance CEO Chae-beom Na

Across the financial landscape, traditional business models are under pressure to adapt to macro forces like demographic shifts, technological acceleration, and climate volatility.

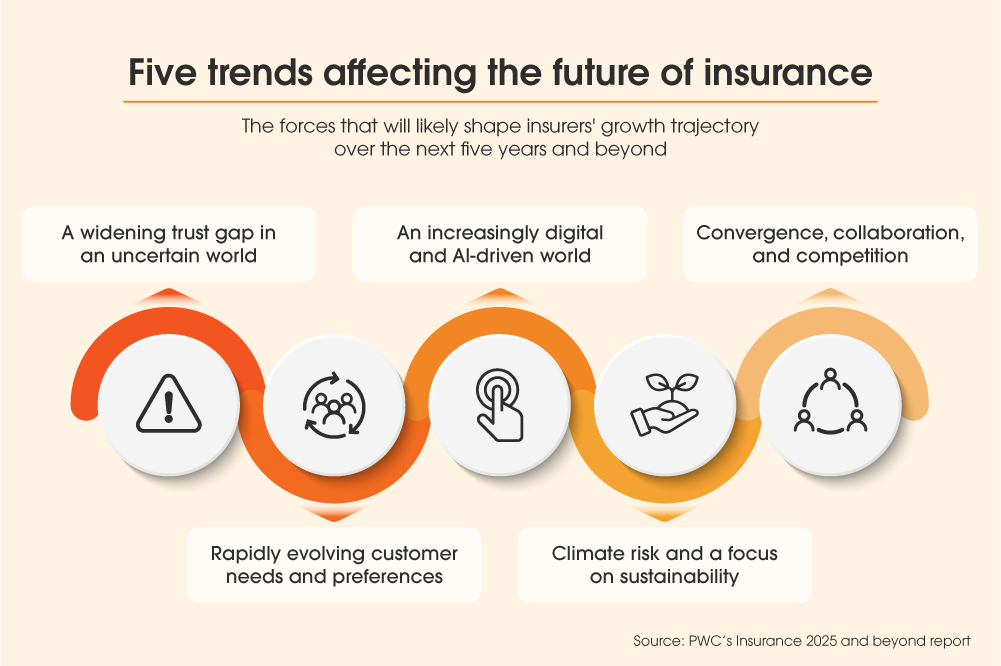

These forces are prompting financial institutions to reexamine their services: not just by refining their product portfolios, but by fundamentally rethinking the roles they play in the diverse lives of customers. A recent PwC report on insurance in 2025 and beyond spotlights the need for the sector to move “from protection to prevention, from indemnification to assistance, and from a transactional relationship to one centered on long-term value and trust.”

In an interview for our Envisioning the future series, Hanwha General Insurance CEO Chae-beom Na shares how the company — and Hanwha’s broader financial businesses — are navigating this pivot through market expansion, AI-led transformation, and personalized product creation that meets the customer’s evolving needs.

Finance in an era of change: what’s forcing the shift?

Most OECD nations are grappling with declining birthrates and aging populations, trends expected to destabilize long-standing insurance and pension systems. These shifts, Na observes, “are pushing the financial sector to redefine its fundamental role and business model.”

“Climate change adds another layer of unpredictability and the potential for large-scale loss,” he adds. “Financial companies in advanced countries are responding to these conditions by improving their disaster prediction capabilities and strengthening capital reserves to prepare for major losses.”

In a bid to navigate these pressures, Hanwha is expanding into new, underrepresented markets. The company’s global ambition isn’t just about building a diversified and resilient portfolio amid evolving risk, but about recognizing opportunity and developing accessible, locally attuned financial offerings that reflect a wider range of customer needs and contexts.

For example, Indonesia — backed by a large and relatively young population — is a financially underrepresented region with sharp growth in digital financing expected. With the acquisition of Indonesian firms Nobu Bank, Lippo General Insurance, and Ciptadana Securities, Hanwha’s financial affiliates have “laid the groundwork for full-scale expansion into the Southeast Asian market,” Na says. By acquiring major banking, insurance, and securities companies, “[Hanwha] plans to proactively respond to local customer needs by applying the product and service expertise built in Korea.”

While making inroads in the global market, Hanwha seeks to become a long-term financial partner — one focused on enabling individuals and society to thrive through accessible solutions. Within these solutions, technology plays a critical role.

Hanwha AI Center

Innovation that builds trust, not just efficiency

While international expansion extends reach, technological innovation, as with most industries, is redefining how services are delivered. Na sees the accelerated development of AI in finance as a critical enabler of personalized services at scale. “The key lies in how we utilize and connect technologies to create customer experiences and revenue structures,” he says.

Hanwha is already applying AI across operational and customer-facing systems — with real-time claims support and smart contact centers offered by Hanwha Life’s Artificial Intelligence Contact Center (AICC). These technologies are not just improving efficiency; they’re helping to shift the business model from product-centric to platform-based, where services are tailored to individual needs and preferences.

“The advancement of technology is creating a new paradigm,” Na explains. “Hanwha financial affiliates are preparing to turn this point of transition into an opportunity. We must recruit and nurture employees who can understand data and develop plans based on it; we must embrace digital capability not merely as a tool, but as part of our identity; and we must continuously evolve around customer experiences, ultimately emerging as a game-changer that leads the market.”

With this vision in mind, the Hanwha AI Center (HAC) in San Francisco marks another important addition to the Hanwha portfolio. Jointly established by Hanwha Life, Hanwha General Insurance, and Hanwha Asset Management, it functions as a strategic hub to explore global AI trends and turn them into applied innovations. Located in one of the world’s most active AI ecosystems, HAC is helping to develop next-generation financial services while fostering collaboration with leading organizations and figures in AI research and development.

As AI continues to reshape the industry, Hanwha is positioning itself to adapt — moving from legacy risk models toward real-time, data-informed decision-making.

Personalized product offerings that close care gaps

If technology and global reach are helping Hanwha scale, differentiated product design is helping it stay relevant. At Hanwha General Insurance, one area of focus is femtech — a field aimed at closing gender-specific care gaps in financial and health coverage.

Under this strategy, Hanwha has launched the Signature Women’s Health Insurance series, which includes coverage tailored to pregnancy, childbirth, mental health, and even aesthetic care. Developed in partnership with leading South Korean medical institutions, it reflects two years of targeted research and has earned 17 exclusivity rights in the domestic market to date.

The success of the Signature line illustrates a broader shift in customer expectations. “Customers no longer expect insurance companies to merely provide products,” Na notes. “Instead, insurers are now expected to expand as partners who help address anxieties and risks throughout various aspects of customer lives.”

As Hanwha General Insurance looks ahead, it is doing so with a clear set of priorities: expanding its reach in future-facing markets, embedding AI across the business, and designing services that reflect the realities of modern life. By aligning digital innovation with deeper relevance, the company is aiming to redefine what trust — and value — looks like in the next era of finance.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee