The AI innovations transforming finance and insurance

A digital revolution is transforming personal finance and insurance services, making the days of handling routine finances through trips to brick-and-mortar buildings, or even phone calls, obsolete. The COVID-19 pandemic significantly accelerated the adoption of digital services, and the technology behind these services continues to advance.

Online services now provide information more quickly and accurately than ever before. This increased access to information enables companies to offer tailored products that cater specifically to each customer’s unique needs. The era of one-size-fits-all is fading, replaced by personalized, convenient services that are reshaping the industry.

Artificial intelligence (AI) is at the forefront of accelerating the reshaping of the finance and insurance industries. At its core, AI refers to the simulation of human intelligence by machines, particularly computers. While AI cannot replicate the empathetic judgments or personal experiences that humans bring, it excels in processing and analyzing vast amounts of data far beyond human capability. Complex algorithms can be applied to AI programs, enabling them to identify patterns and make decisions quickly and accurately. Additionally, AI can manage tedious, repetitive tasks tirelessly and without the errors that humans inevitably make. When AI’s capabilities are combined with other digital innovations, it is possible to create powerful applications that save customers time, money, and the headaches often associated with financial and insurance processes.

AI innovations in insurance

Insurance plays a vital role in providing security and peace of mind, and as people increasingly rely on digital services for their financial needs, the insurance industry is also undergoing a significant transformation to meet these new expectations. AI is reshaping the insurance industry by enhancing efficiency, accuracy, and customer experience. An exciting innovation in this area is the recent creation of AI optical character recognition (OCR), which is changing the way insurance companies handle claims and customer data. It is capable of digitizing printed text, allowing for data extraction and processing insurance claims. OCR enhances processing speeds, eliminates duplication and human error, and provides deep data insights, helping insurers to control costs and improve customer retention. Additionally, it ensures document security and enables efficient management of fraudulent claims. OCR is also valuable in handling disputes involving multiple parties or complex legal issues.

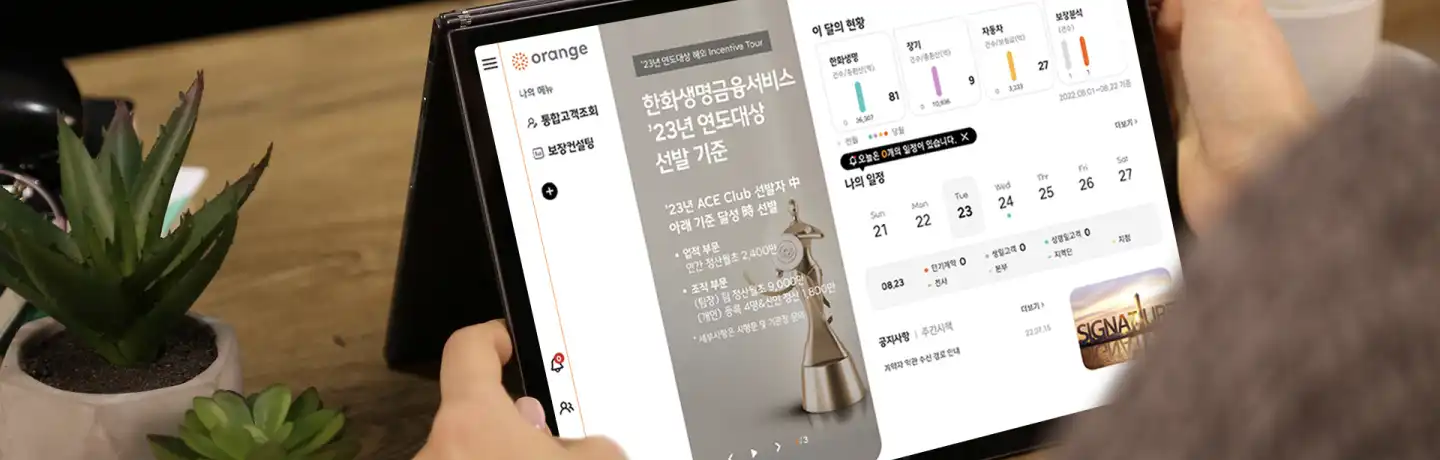

Hanwha Life, South Korea’s oldest insurance firm and a pioneer in digital innovation, integrates AI OCR to streamline and enhance its claims processing and product development. By utilizing AI OCR, Hanwha Life can process complex medical documents, automatically extracting detailed information regarding treatment types and associated costs from medical billing statements, which often vary between institutions. This allows the company to parse and interpret intricate data that would be challenging to manage manually, thus streamlining the claims process.

Additionally, AI is being used to offer a new form of car insurance called behavior-based insurance (BBI). This innovative model allows insurance premiums to be adjusted according to how much and how safely a person drives, providing a more personalized and fair pricing structure. For example, Carrot Insurance, a Hanwha subsidiary, utilizes AI to calculate premiums based on a driver’s safety score, ensuring that customers pay rates that reflect their individual driving habits. This approach not only benefits consumers by offering tailored pricing but also encourages safer driving behaviors.

AI and digital innovations in finance

The finance industry is also undergoing significant transformation due to AI and digital technologies. One such trend is the innovation of robo-advisors, which use complex algorithms to provide financial advice without the need for human input. These digital platforms typically ask users about their financial situation and goals through an online survey, and then use this data to provide tailored investment advice and automatically manage portfolios. This data-driven approach enables robo-advisors to offer personalized advice for customers’ specific needs, quickly and reliably.

Another digital innovation transforming finance is electronic Know-Your-Customer (e-KYC). Opening a bank account used to be a time-consuming and burdensome experience, which required a trip to the bank branch and a lengthy process of confirmation. Today’s digital platforms have revolutionized this process through the use of e-KYC technology which employs advanced facial recognition algorithms and AI to verify the identity of customers quickly and accurately. This not only makes identity verification faster and more convenient but also enhances security by significantly reducing the risk of identity fraud.

Pinetree Securities, a Hanwha Investment & Securities Co. subsidiary, offers a digital investment platform which exemplifies how e-KYC can be implemented effectively. The integration of e-KYC into its suite of mobile trading apps allows for enhanced security, fraud prevention, and streamlined onboarding process. It also means that new customers can open an account in just 2 minutes, allowing them to begin trading almost immediately. This seamless integration of technology exemplifies how digital innovations are reshaping the financial landscape.

Continuing innovation in finance and insurance

Technological advancements in finance and insurance are revolutionizing the way these services are delivered, making them more efficient, personalized, and accessible to people around the world. Companies like Hanwha are at the forefront of this transformation, utilizing innovative technologies to better serve their customers and provide better financial security. As the industry continues to evolve, the ability to innovate and tailor services to meet the diverse needs of individuals will be key to driving further progress.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee