Fintech Trends: 4 Insights for Today and Tomorrow

Digital technologies, from AI to big data, are transforming the world of personal finance.

Over the past decade, a massive shift has occurred within the digital finance sphere as mobile apps and technological advances have placed an array of personal finance tools in the palm of our hands. This industry transformation has only accelerated in the wake of the COVID-19 pandemic, when billions of people around the world turned to digital tools for managing their day-to-day tasks, including investments and finances.

At the forefront of this transformation is Hanwha, which aims to go beyond traditional finance and provide digital-based financial solutions optimized for a variety of lifestyles. Embracing its mission to enhance the lives of its stakeholders, Hanwha’s financial affiliates have developed a range of innovative products and services that are designed to contribute to the sustainable prosperity of its customers by making personal finance more accessible, convenient and user-friendly than ever before.

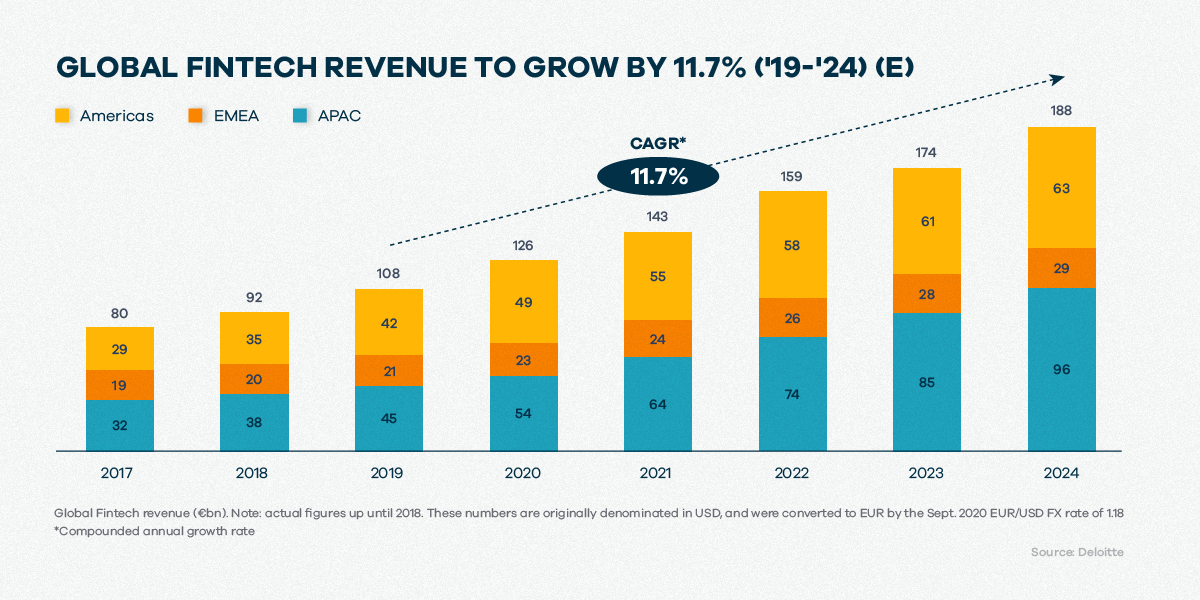

As global fintech revenue continues to climb, financial institutions are exploring new ways to meet the rapidly evolving needs of their users. Check out these four emerging personal finance trends resulting from the digital revolution and discover how they can enhance your life.

1. Personalized Finance: Centered on You

Personalization is a growing trend in many industries, and finance is no exception. Personalization is crucial for customers in the financial services industry, with 72% of them considering it "highly important" in today's landscape. With the help of advanced analytics and artificial intelligence, financial institutions can gather and analyze data about their customers' financial habits, goals and preferences. This, in turn, drives better performance and better outcomes. Personalized finance goes beyond just tailored investment advice and financial planning to include other services catering to the unique needs and preferences of individual users.

One such brand is Hanwha’s LIFEPLUS, a shared vision of Hanwha’s financial affiliates that delivers personalized financial solutions to its customers based on their individual needs and goals. The brand is applied to different apps and initiatives put forth by each financial affiliate of the Hanwha Group. Hanwha Life, Hanwha General Insurance, Hanwha Investment & Securities, Hanwha Asset Management and Hanwha Savings Bank are united in an effort to offer financial, physical, mental and inspirational wellness products and services to promote a more balanced lifestyle. LIFEPLUS’s concept of “holistic wellness” will enhance the lives of its users during their lifelong journey of positive change and continuous growth.

In addition, Hanwha also offers the LIFEPLUS TRIBES app, which links users with virtual communities based on their hobbies and interests, promotes overall well-being and provides personalized product recommendations. Users can participate in challenges with their “tribes” or virtual communities based on shared interests such as sports, art, gastronomy, music and fireworks. This enhances their lives with wellness and a sense of community.

Overall, the personalization trend is likely to continue in the years ahead as consumers increasingly demand tailored experiences and companies seek to differentiate themselves in a crowded marketplace.

2. Fractional Shares: Investing Made Accessible

Investing is the one thing all the wealthiest people have in common. But now, investing isn’t just for the top 1%. Fractional investing is challenging the dynamics of traditional investing and making it more accessible to people from every lifestyle. So, what are fractional shares? Instead of buying a whole share of stock, people can buy a fractional share, which is like a "slice" of stock representing a partial share. Lowering the financial barriers to entry makes fractional investing one of the best and most approachable investments for beginners. Fractional investing rose in prominence during the pandemic because people were spending more time at home, saving more money and looking for ways to invest their extra cash. Combined with an increase in digital brokerage apps, it’s now easier than ever for people to build a diversified investment portfolio without investing large sums of money upfront — all from the comfort of home.

In line with this trend, Hanwha Investment & Securities offers a mobile app called STEPS which allows users to invest in fractional shares of stocks. It's designed to be user-friendly and accessible, showing people the basic steps of how to invest in stocks, even if they don't have a lot of previous experience. Hanwha Investment & Securities’ subsidiary in Vietnam, Pinetree Securities, also offers several mobile apps to educate new users about investing and help them make informed decisions, including PineX, Pinetree AlphaTrading and Stock123. Stock123 is a stock learning app, while PineX and Pinetree AlphaTrading are mobile trading systems that provide real-time market data, news and reports to help users track and analyze their investments. With Stock123 for beginners, PineX for experienced traders and Pinetree AlphaTrading for professional traders, Hanwha is ensuring that all users can learn and grow at any level.

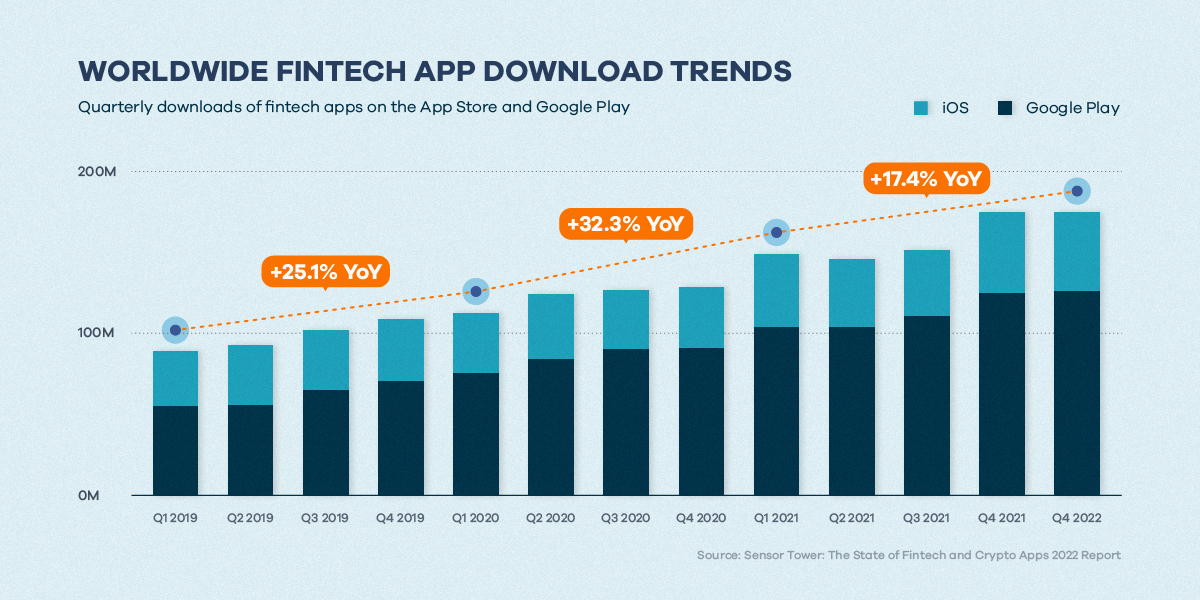

3. Mobile Banking: The New Normal

It's not just investing that's gone digital. Banking has too, and the younger generation is leading the charge, leveraging mobile apps to manage their finances in ways that were unimaginable just a few years ago. According to a recent survey, 99% of Gen Z and 98% of millennials use a mobile banking app for various tasks, such as checking balances, paying bills and transferring funds. What’s more, during the COVID-19 pandemic, Gen Z spent double the amount of time on finance apps compared to pre-pandemic use. With installs of fintech apps growing by 32% between 2020 and 2021, this trend is expected to continue into 2023 and beyond, with an increasing shift towards digital banking, online platforms and other digital tools that make finance more accessible.

Hanwha Asset Management is embracing this trend by offering a mobile app called PINE, tailored explicitly to Gen Z and Millennial users. Considering that these younger generations tend to have access to less capital and lack experience and information compared to professional investors, PINE includes budgeting tools, investing advice for beginners and easy-to-understand financial education resources, all designed to help younger users manage their finances more effectively in the digital age. For users new to investing, the app features optimized pension solutions and 11 funds carefully selected by professional traders. With these convenient features, PINE aims to level the investing playing field for its Gen Z and Millennial customers.

The benefits of mobile banking also extend to security. Pinetree Securities’ e-KYC (electronic Know-Your-Customer) technology uses facial recognition and AI to verify the identity of customers, leading to faster and more convenient identity verification, improved security and accuracy and reduced costs for financial institutions, providing better customer experiences overall. With these mobile financial solutions, Hanwha is helping millennials and Gen Z set themselves up for financial success.

4. Super Apps: The App for Everything

What is so super about super apps? In the past, people often had to use multiple apps or websites to manage different aspects of their lives, including their finances, insurance and health, which could be time-consuming and confusing. However, the rise of super apps within the finance industry is changing that. Super apps, already highly popular in Asia and Africa, offer a range of services in one place, from banking and payments to shopping and transportation. The popularity of super apps reflects a broader trend towards digital transformation and combining multiple services in a single platform, which is expected to continue as consumers increasingly seek more convenient and streamlined ways to manage their financial lives.

Hanwha Life Vietnam's LIME is one super app that offers users a one-stop shop for finance, insurance, lifestyle, wellness and more. With LIME, users can access a range of financial services, including insurance, investment management and more. They can also use the app to manage contracts online, obtain insurance product information, pay insurance premiums online and access wellness and lifestyle content via social networking features. By offering all these services in one place, LIME provides users with a more convenient and streamlined way to manage their financial lives.

The Future of Fintech Begins Today

Digitalization is laying the groundwork for a better financial future. Trends like personalization, fractional investing, mobile banking and super apps are all set to define the personal finance industry in 2023 and beyond. In the age of digital transformation, Hanwha is well-positioned to take advantage of these trends with its innovative products and services. From a person just starting their financial journey, an experienced investor looking to diversify their portfolio or someone simply wanting to live a more balanced and fulfilling life, Hanwha has something to offer everyone.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee