What's in a number: 5 figures shaping the future of financial inclusion

Across the world, billions of people remain excluded from the formal financial system — unable to save securely, access credit, or plan for long-term financial stability. In many developing regions, this is due to economic and geographic barriers: irregular incomes, limited infrastructure, and the absence of nearby banking services.

But that landscape is shifting. Mobile banking, digital payments, and AI-powered tools are transforming financial systems — making services more accessible, secure, and affordable. What was once a luxury of advanced economies is now a catalyst for inclusion in high-growth, underbanked markets. And Hanwha is investing in that future.

This article explores five key figures that illustrate how fintech and AI are helping reshape financial access.

Globally, 1.3 billion adults remain unbanked — meaning they have no formal way to save, receive wages, or access credit. Yet many already own a mobile phone, possess ID, and use a registered SIM, giving them the basic tools to join the digital financial system. What’s missing are services designed for first-time users: simple, secure, and tailored to local needs.

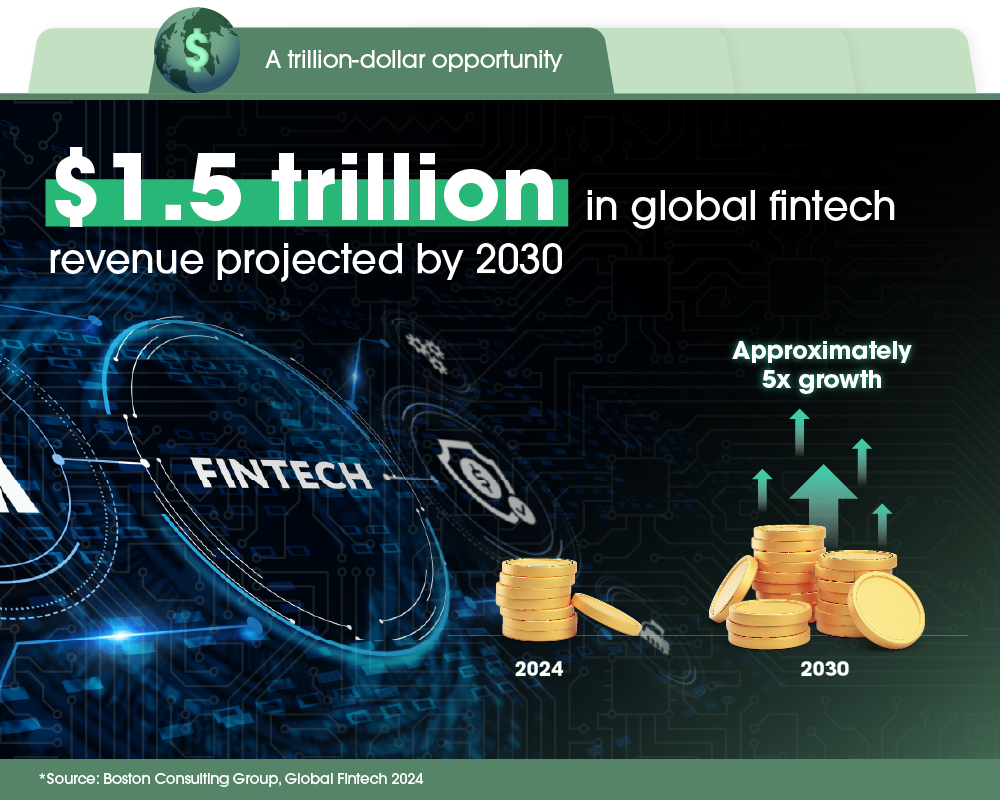

Fintech is projected to generate $1.5 trillion in annual revenue by 2030, with nearly half of that growth coming from emerging markets. While fintech companies currently account for just 3% of banking and insurance revenues, they are growing three times faster than incumbents. As access to mobile phones and digital IDs expands, companies are racing to deliver AI-powered solutions, from micro-investment platforms to chat-based financial coaching. Financial inclusion isn’t just a social good — it’s a rapidly scaling business model.

Across emerging markets, mobile-first finance is reshaping how people pay. In Indonesia, digital transactions jumped 226% in 2024, driven by widespread use of mobile apps, QR payments, and instant transfers. Similarly, Nigeria’s fintech sector grew by 70% last year, while Egypt’s ecosystem expanded 5.5-fold over five years — all demonstrating how digital infrastructure is reshaping everyday finance globally.

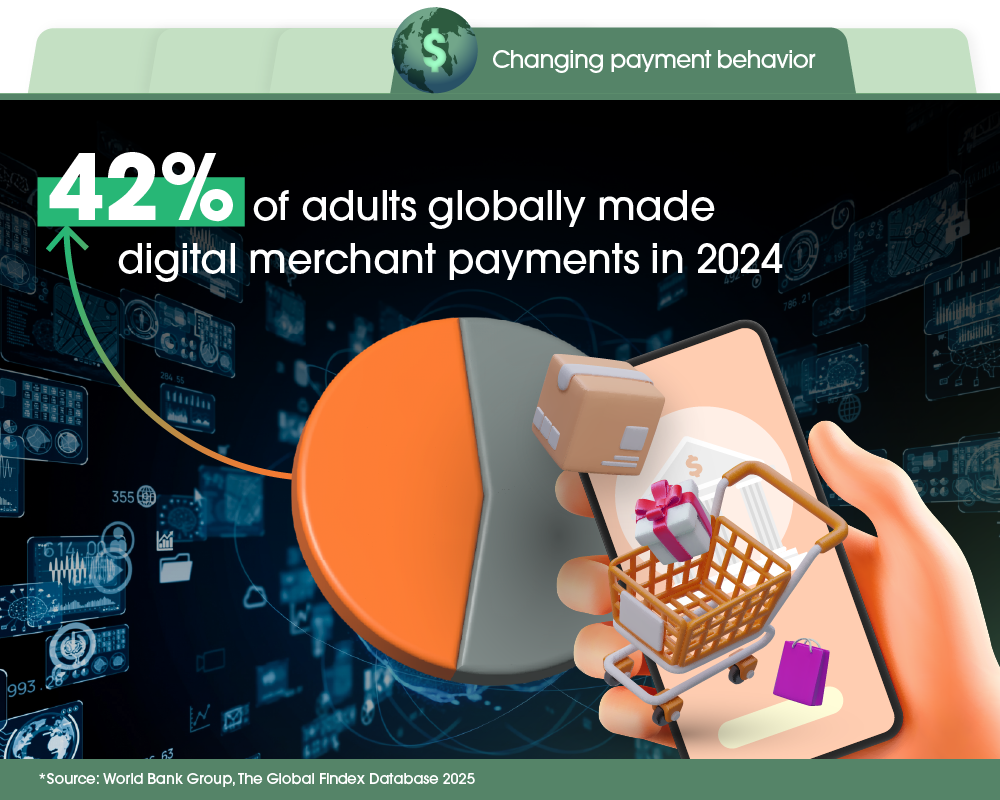

As of 2024, 79% of adults worldwide have a financial account, up from just 51% in 2011 — a dramatic expansion of access. But access is only part of the story: 42% of adults are now using those accounts for digital merchant payments, signaling a meaningful shift in day-to-day financial behavior. In low- and middle-income economies, mobile-first platforms are rapidly replacing cash, laying the foundation for broader access to credit, savings, and long-term financial resilience.

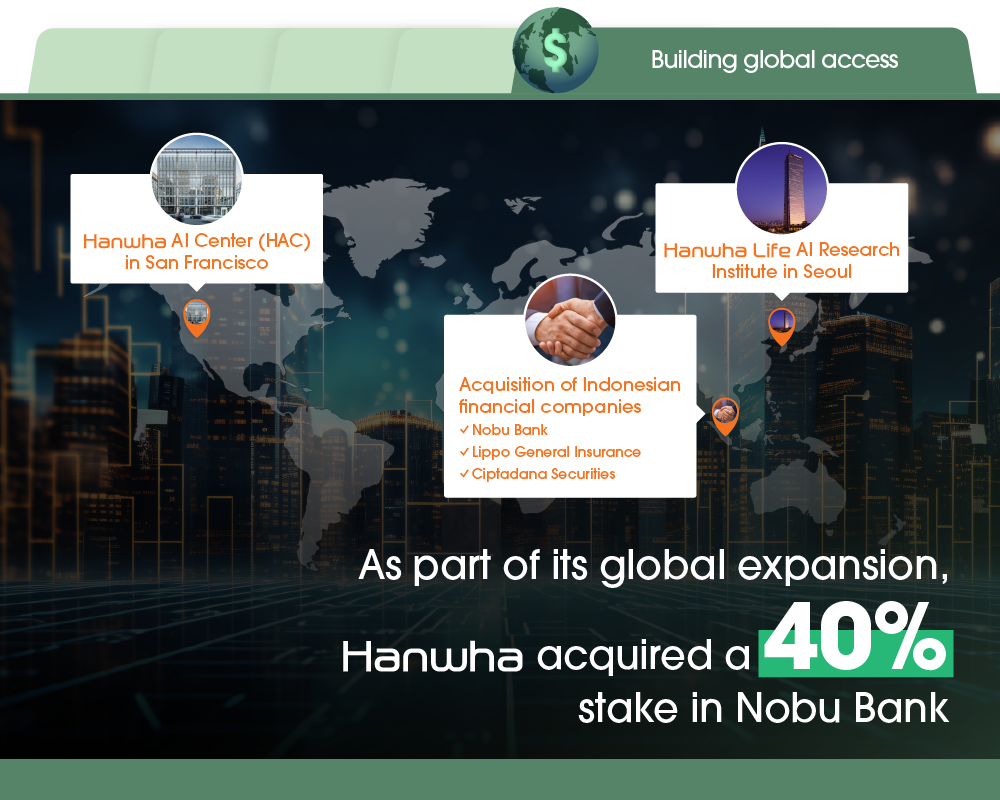

Hanwha Life has acquired a 40% stake in Nobu Bank, marking its first overseas banking investment. The move combines Hanwha’s digital finance capabilities with Nobu’s local presence, aiming to expand hybrid services across digital and mobile-first channels in one of Asia’s fastest-growing markets.

At the same time, Hanwha is investing in shaping the future of finance through AI. The Hanwha Life AI Research Center is exploring the long-term impact of AI on the financial industry, while the Hanwha AI Center (HAC) in San Francisco is working with leading AI companies to develop next-generation solutions that enhance its core products and services, making them smarter, easier, and more accessible worldwide.

Get the latest news about Hanwha, right in your inbox.

Fields marked with * are mandatory.

- Non-employee

- Employee